The best Side of Can I File Bankruptcy More Than Once in Virginia?

Throughout the procedure, your selected debt relief business collaborates using your creditors to secure favorable phrases, which include lessened balances or desire prices.

However, Chapter 11 and twelve recommendations may not be as quick and straightforward as mentioned earlier mentioned if you violated a court docket buy or had a scenario dismissed throughout the 180 days previous your bankruptcy submitting. In either of these cases, you might not instantly qualify for an additional discharge.

You might require to possess a sure level of unsecured credit card debt to get accepted right into a debt consolidation program (one example is, $7,500 or more). In the event you're having difficulties to maintain up with the minimal payments with your charge cards and financial loans, you could possibly be a great prospect for credit card debt consolidation.

The court docket will appoint a bankruptcy trustee once it opens your bankruptcy case. The trustee is definitely an impartial 3rd party whose position is to control the home while in the bankruptcy estate and also to verify all the data you provided.

Chapter 7 bankruptcy is a liquidation bankruptcy that helps you to discharge most of your respective unsecured debts, like bank card financial debt and health care bills.

When it comes to submitting for bankruptcy for the next time, it can be crucial to understand the ready restrictions And the way they utilize for your case.

Make sure they clarify their service fees Plainly and preserve affordable and transparent Charge constructions to forestall unexpected bills.

Additionally you might be required to meet Using the people you owe revenue to, and Stay beneath a court-ordered price range for as many as 5 several years. Which's just First of all.

Bankruptcy also offers a means for creditors being taken care of fairly. The debtor is the individual see post or business who owes funds, plus the creditor is basics the person to whom the money or assistance is owed.

When there might not be a limit to how persistently you may file for bankruptcy, there are some effects. Sometimes, you might not receive the security of the automated keep and/or it's possible you'll problems your credit rating rating.

If you’re dealing with considerable credit card debt and you’re fearful you could’t shell out it, you may want to think about submitting for bankruptcy to secure a money imp source fresh new start.

More normally, Chapter eleven will allow a business to remain Energetic while having to pay creditors about a specified time period.

The waiting around periods are created to prevent abuse on the bankruptcy process and making sure that debtors aren't utilizing bankruptcy as a method to avoid shelling out their debts[2]. In the event you are looking at submitting for bankruptcy in North Carolina, it is crucial to be aware of the different types view website of bankruptcy and the eligibility prerequisites for every. Chapter 7 bankruptcy is often a liquidation bankruptcy that lets you discharge most of the unsecured debts, including bank card credit card debt and health-related expenses[5]. Chapter thirteen bankruptcy is usually a reorganization bankruptcy that means that you can repay your debts more than a duration of three to five years[six]. Here are several key takeaways pertaining to filing for bankruptcy more than once in content North Carolina:

The principle constraints entail waiting intervals in between filings for Chapter seven and Chapter 13 bankruptcies. Should you file various situations far too swiftly, you might not have the ability to discharge your debts. The waiting around durations are:

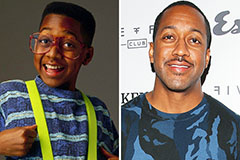

Jaleel White Then & Now!

Jaleel White Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Shane West Then & Now!

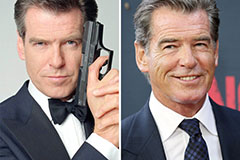

Shane West Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!